India vs China Manufacturing: Which Is Better for Your Business in 2025?

For decades, China has been the undisputed global manufacturing powerhouse. However, in recent years, India has been rapidly gaining ground, offering competitive advantages in cost, labor, and innovation. As we enter 2025, many business leaders face a decisive question: Should they manufacture in India or China? This blog breaks down the key differences between the two manufacturing giants to help you make an informed decision.

Labor Costs and Availability

China continues to offer an enormous labor force with high productivity. However, wages have been steadily rising over the past decade. The average annual manufacturing wage has exceeded $10,000 in urban areas, making low-cost production less viable in some sectors.

India, in contrast, offers one of the largest and youngest labor pools in the world with over 900 million working-age individuals. Labor costs remain significantly lower and are often 50 to 60 percent less than in China depending on the region and skill level. For businesses focused on cost-effective production, India provides a strong competitive edge, particularly in labor-intensive sectors.

Infrastructure and Logistics

China’s manufacturing infrastructure is world-class. It includes high-speed rail systems, smart factories, and deep-sea ports. Its logistics ecosystem is mature, reliable, and tightly integrated with global trade networks, enabling faster production turnaround and lower transportation costs.

India has made strong progress through initiatives such as “Make in India” and “PM Gati Shakti.” Key industrial corridors like Delhi-Mumbai and Chennai-Bangalore are improving in efficiency. However, logistical challenges still exist in remote areas. While India’s infrastructure is improving, it currently lacks the speed and scale of China’s logistics system.

Government Policies and Incentives

The Chinese government continues to support manufacturing through tax incentives and subsidies across major sectors such as electronics and green technology. However, navigating China’s regulatory environment can be complex. Additionally, growing geopolitical tensions with Western nations have created uncertainties for some global investors.

India has responded with business-friendly reforms. These include Production Linked Incentive (PLI) schemes for multiple sectors and 100 percent foreign direct investment in most industries. Regulatory procedures have been streamlined through digital portals, offering a more accessible entry point for foreign manufacturers and investors.

Technology and Innovation Capabilities

China leads in high-tech manufacturing, including electronics, robotics, and electric vehicles. Its factories are heavily automated and highly efficient, making it the preferred destination for companies seeking advanced and large-scale production. Investments in Industry 4.0 technologies are widespread. Many factories are integrating artificial intelligence, IoT, and data analytics.

India excels in engineering, software development, and digital transformation. Its strength lies in tech-enabled manufacturing and innovation-driven services. Although India is still developing its automation infrastructure, its ability to combine manufacturing with IT capabilities makes it an attractive destination for smart, scalable solutions.

Supply Chain Diversification and Risk Management

Recent global events such as the COVID-19 pandemic and geopolitical conflicts have highlighted the risks of depending too heavily on a single manufacturing source. Many companies are now adopting a China plus one strategy to diversify and strengthen their supply chains.

India is emerging as a strong alternative for companies seeking a politically stable environment, competitive manufacturing costs, and expanding production capabilities. It offers a practical balance between cost, risk, and quality for long-term sourcing.

Quality and Compliance

Chinese manufacturers have made significant progress in meeting global quality standards including ISO, CE, and RoHS certifications. Although quality and consistency can vary among smaller suppliers, large-scale manufacturers in China are generally reliable and produce high-standard outputs.

India has also improved in compliance, especially in sectors such as pharmaceuticals, automotive, and textiles. International certifications like WHO-GMP and ISO are increasingly common. However, just like in China, the quality of output in India largely depends on proper supplier selection and ongoing monitoring.

Environmental and Ethical Considerations

China has implemented stricter environmental regulations and is making efforts to shift toward greener industrial practices. Despite these improvements, pollution and emissions remain significant concerns in some industrial regions.

India is also investing in green manufacturing. There is an increasing focus on solar-powered factories, sustainable materials, and eco-friendly logistics. While progress is being made, the enforcement of environmental and labor standards can still be inconsistent in certain areas. Companies sourcing from either country must conduct thorough evaluations to align with sustainability and ethical sourcing goals.

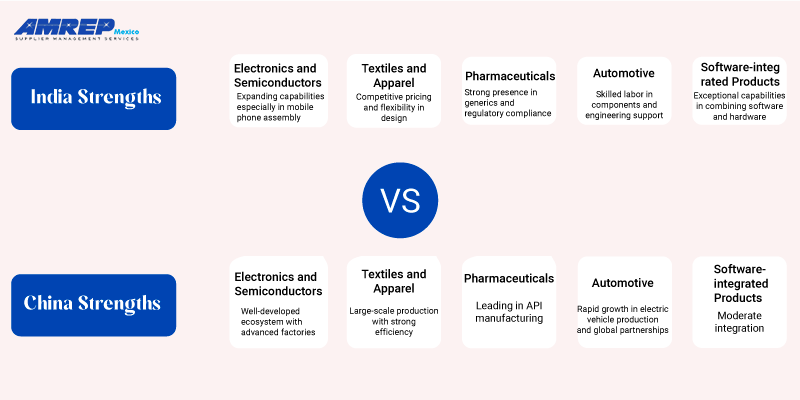

Industry Focus and Sector Strengths

Choosing the right manufacturing destination often comes down to which country aligns best with your industry’s specific demands and strengths. Let’s explore how India and China compare across key sectors.

| Sector | China Strengths | India Strengths |

|---|---|---|

| Electronics and Semiconductors | Well-developed ecosystem with advanced factories | Expanding capabilities especially in mobile phone assembly |

| Textiles and Apparel | Large-scale production with strong efficiency | Competitive pricing and flexibility in design |

| Pharmaceuticals | Leading in API manufacturing | Strong presence in generics and regulatory compliance |

| Automotive | Rapid growth in electric vehicle production and global partnerships | Skilled labor in components and engineering support |

| Software-integrated Products | Moderate integration | Exceptional capabilities in combining software and hardware |

Which Is Better for Your Business in 2025?

India versus China manufacturing - the right decision depends on your specific goals, industry, and the scale and complexity of your operations.

China remains a top choice for businesses seeking high-tech, large-volume production with sophisticated infrastructure and integrated logistics. India, on the other hand, offers compelling advantages for cost reduction, workforce scalability, and diversifying your supply chain strategy.

In 2025, many companies may find that a hybrid sourcing model delivers the best results. Leveraging China’s efficiency and infrastructure alongside India’s affordability and growing manufacturing ecosystem can provide both resilience and long-term competitiveness.

How AMREP Mexico Supports Smarter Manufacturing Decisions

At AMREP Mexico, we understand that global sourcing decisions carry long-term implications for cost, quality, and supply chain resilience. Whether you’re considering China, India, or a hybrid approach, our expert team is here to help you evaluate your options, vet suppliers, and implement manufacturing strategies tailored to your business goals.

With decades of experience in global procurement and quality control, AMREP Mexico empowers companies to make smarter sourcing decisions that support sustainable growth in an ever-evolving marketplace.

Partner with AMREP Mexico to strengthen your global manufacturing strategy — with confidence, clarity, and control.