How to Diversify Your Supply Chain Beyond China: Key Considerations

China still leads in global manufacturing, but changing economic conditions, policy shifts, and supply chain vulnerabilities mean businesses can no longer rely on a single source. The decision to move or diversify production requires a structured approach: identify operational priorities, evaluate market alternatives, assess infrastructure and regulatory environments, and map potential risks.

This guide breaks down the key considerations, helping you choose a location that balances cost efficiency with long‑term resilience.

Why Manufacturers Are Moving Away from China

For decades, China was uncontested in global manufacturing. Its unmatched production scale, skilled labor force, and export infrastructure made it the go-to destination for brands across industries. However, this dominance is now facing growing challenges that are pushing companies to diversify their supply chains.

Some of the most pressing reasons for this shift include:

- Rising Labor Costs: China’s wages have increased steadily by over 7% annually for the past decade, making it less cost-competitive compared to countries like India, Vietnam, or Mexico.

- Geopolitical Tensions: U.S.–China trade disputes, tariffs, and political uncertainty have created risk for companies heavily reliant on Chinese manufacturing.

- COVID-19 Aftermath: The pandemic highlighted the dangers of over-reliance on a single manufacturing location. China’s strict lockdown measures and centralized control over logistics caused widespread production delays and shipping disruptions. Companies found themselves unable to fulfill orders, revealing just how vulnerable global supply chains can be when concentrated in one country.

- Environmental & ESG Pressures: Western markets are increasingly pressuring suppliers to comply with ESG (Environmental, Social, and Governance) standards. Concerns over carbon emissions, waste management, and social compliance have forced companies to rethink their sourcing strategies. Additionally, transparency issues in verifying ESG compliance within China make it harder for brands to meet their sustainability commitments.

- IP and Data Concerns: Companies in sensitive sectors worry about IP protection and cybersecurity risks when manufacturing in China.

All these factors have given rise to the “China + 1” strategy. In this approach, companies keep some operations in China to benefit from its strengths while expanding into other countries to reduce dependence and build supply chain resilience.

Where Are Companies Moving Their Manufacturing Beyond China?

As companies reassess their global footprint, several countries have emerged as attractive alternatives:

| Country | Strengths | Limitations |

|---|---|---|

| Vietnam | Low labor costs, improving infrastructure, free trade agreements | Limited capacity, rising wages, over-reliance on raw materials imports |

| India | Huge labor pool, strong engineering base, cost competitiveness | Complex bureaucracy, infrastructure gaps |

| Thailand | Strategic ASEAN location, government incentives, skilled labor | Smaller scale than China, supply chain gaps in high-tech sectors |

| Mexico | Proximity to U.S., USMCA benefits, competitive wages | Security concerns, regulatory complexity |

| Indonesia | Growing industrial base, resource-rich, young workforce | Infrastructure development still in progress |

Choosing the right location depends on your product type, target market, logistics needs, and regulatory comfort.

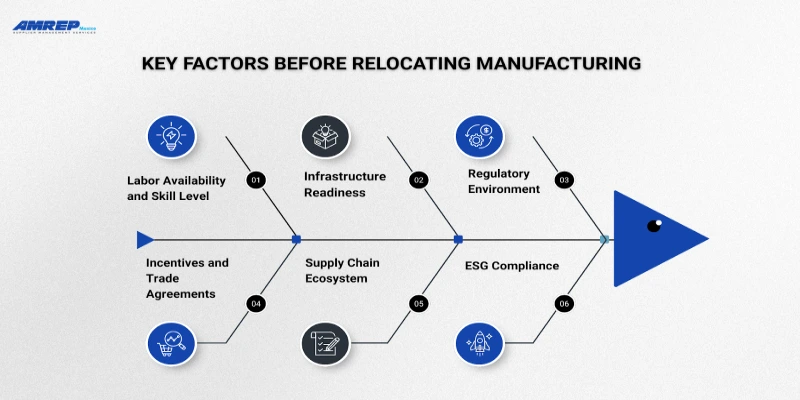

What Key Factors Should You Evaluate Before Relocating Manufacturing?

Shifting manufacturing to a new location is a high-stakes decision that can impact costs, quality, and long-term competitiveness. Before making the move, companies should carefully assess these critical factors:

1. Labor Availability and Skill Level

Ensure the region has a workforce with the right expertise for your industry. For example, electronics manufacturing demands precision technical skills, while garment production requires a high volume of trained sewing operators. The talent pool must match your production needs today and scale with future growth.

2. Infrastructure Readiness

Efficient production depends on reliable infrastructure. Well-developed roads, ports, power supply, and internet connectivity directly affect delivery times, logistics costs, and overall operational efficiency.

3. Regulatory Environment

Understand the ease or difficulty of setting up and operating in the new market. This includes business registration processes, labor laws, tax obligations, and compliance requirements that could influence both speed and cost of entry.

4. Incentives and Trade Agreements

Investigate whether the government offers benefits such as tax breaks, subsidies, or grants for manufacturers. Also, consider trade agreements that may reduce tariffs and open access to key export markets.

5. Supply Chain Ecosystem

Evaluate the availability and reliability of local suppliers, logistics providers, and raw materials. A strong supplier network ensures smoother operations, reduces lead times, and helps maintain quality standards.

6. ESG Compliance

Confirm that the new location can meet your Environmental, Social, and Governance (ESG) standards. This includes environmental sustainability, ethical labor practices, and transparency, which are increasingly vital for brand reputation and compliance with global buyers.

Making these evaluations early helps avoid costly missteps later.

What Are the Hidden Challenges in Manufacturing Relocation?

Many companies underestimate the operational friction involved in leaving China. Here are common challenges they encounter:

- Disruption During Transition: Shutting down a well-oiled operation and restarting elsewhere can slow down output, delay shipments, and affect product quality.

- Loss of Supplier Relationships: China offers deep, mature supply chains. Moving might mean losing relationships that took years to build.

- Training & Ramp-Up Time: Local workers in a new country may require months of training to match previous quality levels.

- Legal and Tax Surprises: Local legal systems may be unpredictable or slow. Taxation laws can be complex.

- Cultural and Language Barriers: These can affect everything from management to negotiation with suppliers.

- IP Protection: Some alternative markets may still lack strong intellectual property enforcement frameworks.

The key is not just to move, but to prepare thoroughly for the operational reality on the ground.

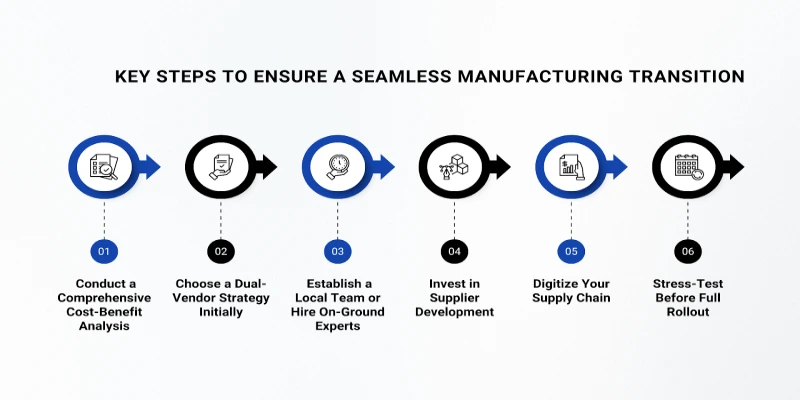

What Are the Key Steps to Ensure a Seamless Manufacturing Transition?

To successfully execute your supply chain shift, consider a phased, strategic approach:

Step 1: Conduct a Comprehensive Cost-Benefit Analysis

Factor in not just labor costs but logistics, quality, tariffs, taxation, and training requirements.

Step 2: Choose a Dual-Vendor Strategy Initially

Don't cut off China immediately. Use a "China + 1" model to ramp up capacity gradually in a second country.

Step 3: Establish a Local Team or Hire On-Ground Experts

You need people who understand the local regulatory, cultural, and logistical environment.

Step 4: Invest in Supplier Development

In less mature ecosystems, you might need to train suppliers, share tooling knowledge, or develop new vendor relationships.

Step 5: Digitize Your Supply Chain

Use technology (ERP, supplier management platforms, etc.) to gain transparency and control over multi-country operations.

Step 6: Stress-Test Before Full Rollout

Pilot production lines, conduct QA audits, and simulate full-order fulfillment before scaling.

Note: Clear communication is the foundation of any successful sourcing relationship. Learn how to establish strong supplier relationships from the start in our guide on setting expectations with new overseas suppliers.

How Are Global Brands Successfully Diversifying Their Manufacturing?

Several well-known brands have already diversified away from China and their journeys offer valuable insights.

Apple

While Apple still relies heavily on China, it’s expanding production in India (iPhones) and Vietnam (AirPods). It’s a classic example of the "China + 1" strategy.

Nike

Nike has significantly shifted production to Vietnam and Indonesia to reduce dependence on China while maintaining low-cost labor.

Samsung

Samsung shut down its last smartphone factory in China in 2019 and moved most production to Vietnam and India.

Lego

The Danish toy giant opened a new plant in Vietnam in 2022 to support growth in Asia while reducing reliance on China.

Hasbro

Hasbro moved 60% of its sourcing out of China by 2021 and is diversifying into India and Vietnam.

These examples show that the shift is not only possible but often profitable—if done right.

What Future Trends Will Shape Global Manufacturing in the Next Decade?

The global manufacturing landscape is in the midst of a transformation. Cost efficiency remains important, but resilience, sustainability, and political stability are now just as critical. As companies rethink their global footprints, these five trends are set to define the next decade:

1. Regionalization Over Globalization

Manufacturers are moving away from far-flung supply chains and setting up production closer to their primary markets. For example, Mexico is becoming a hub for North American demand, while Eastern Europe is increasingly supplying the EU. This approach shortens delivery times, reduces transportation costs, and limits exposure to geopolitical risks.

2. Supply Chain Resilience

The pandemic proved that a single point of failure can cripple production. In response, companies are adopting “just in case” strategies alongside “just in time” efficiency, building multiple sourcing options, diversifying manufacturing bases, and holding strategic inventory reserves to absorb shocks.

3. Smart Factories and Industry 4.0

Advances in automation, robotics, and AI are reshaping competitiveness. Even higher-cost regions can now compete with lower-cost countries by using technology to boost productivity, improve quality, and enable flexible, demand-driven production. Smart factories also allow for predictive maintenance and real-time performance monitoring, reducing downtime and waste.

4. Environmental Sustainability

Sustainability is no longer optional and has become a core business imperative. Governments, investors, and consumers are demanding greener manufacturing. This means shifting to renewable energy, reducing emissions, adopting circular supply chain models, and ensuring ethical labor practices. Companies that fail to adapt risk losing contracts and consumer trust.

5. Nearshoring & Friendshoring

Geopolitical alignment is now a factor in site selection. Nearshoring places production geographically closer to end markets, while friendshoring prioritizes countries with stable political and trade relationships. This reduces tariff exposure and political risk, ensuring supply continuity in uncertain times.

Before engaging a new manufacturing partner, it’s essential to have a clear onboarding process in place. Our Supplier Onboarding Checklist offers a step-by-step guide to ensure a smooth and efficient transition.

How AMREP Supports Strategic Manufacturing Relocation

The global manufacturing environment is in flux, and for many companies, this is an opportunity. Diversifying away from China doesn’t have to be disruptive if approached strategically. The key is preparation, local expertise, and the right partners.

At AMREP, we support manufacturers in diversifying through source inspections, supplier audits, quality control, sourcing strategy, and transition management. Backed by decades of experience and on-the-ground teams in key markets such as Mexico, Vietnam, India, and Southeast Asia, we help build supply chains that are smarter, more resilient, and ready for the future.

Partner with AMREP today—transition your supply chain with clarity, control, and confidence.